Cheapest Term Life Insurance:The Cost of Life Insurance: how much is life insurance? life insurance cost calculator, term life insurance, Understanding the cost of life insurance.

Cheapest Term Life Insurance:The Cost of Life Insurance

Pradhan Mantri Jeevan Jyoti Bima Yojana(PMJJBY)

The lowest cost Life Insurance is PMJJBY. This is a central Govt. of INDIA Bima Policy. The cost of this Life Insurance is less than 1 rupee. It is around Rs.0.90/- per day or Rs.330/- per year.

Understanding the cost of life insurance:

Life inclusion is a bit of your cash related security net that you’ll be paying for a significant long time. That is the reason it’s basic to grasp the cost of your methodology. Everything considered, allowing a course of action to go since you can’t manage its expense refutes the purpose of having it.

Typical cost of life inclusion:

By far most can would like to pay around $300-$400 consistently for their methodology. Nevertheless, particular costs depend upon different factors, including the gathering you’re consigned, your consideration entirety and term length, the riders you pick, and the sort of methodology.

Portrayal:

Additional security associations use groupings to choose how risky you are for them to defend — what are the chances that you’ll fail miserably all through your system? On the off-chance that you’re particularly unfortunate and bound to pass on in the midst of the term of your game plan, you’ll be charged more. On the off-chance that you’re incredibly solid, and there’s little risk that the debacle assurance association should pay the passing favorable position, you’ll get dynamically moderate rates.

Cheapest Term Life Insurance:The Cost of Life Insurance

Groupings are resolved in the midst of the underwriting technique after the underwriter looks:

Your age.: All things considered, the more settled you are, the more you’ll pay forever inclusion. This is a direct result of general declining prosperity and enhancing likelihood of passing on while the methodology is dynamic. Concentrate how fiasco security rates increase with age.

Your prosperity status.: Competitors will normally need to step through a helpful examination and answer request with respect to your family prosperity history and paying little mind to whether you smoke. The protection organization may moreover request an Attending Physician’s Statement (APS) from your expert to get their point of view on your prosperity history.

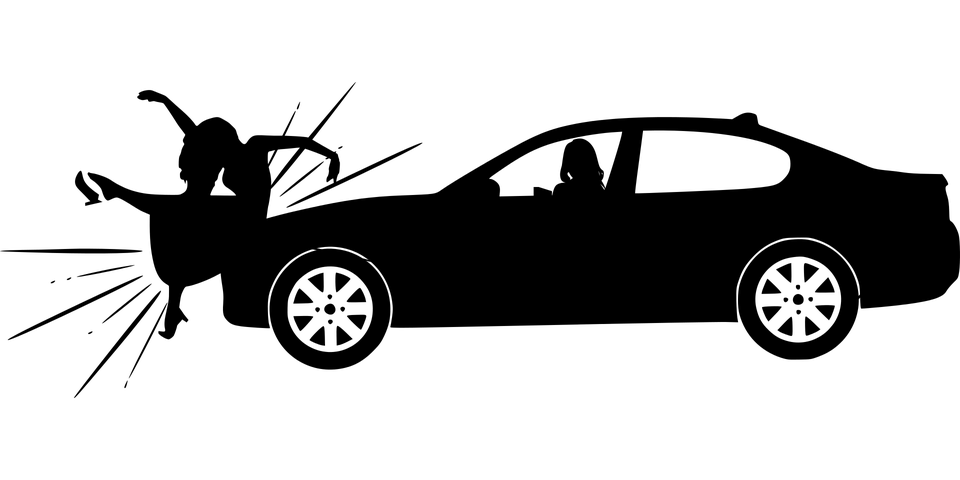

Your driving record.: With a motor vehicle report, the protection organization can check whether you’re an indiscreet driver and bound to get into setbacks.

Your side advantages.: A couple of recreation exercises are more risky than others. If you scuba dive or shake jump on the week’s end, the protection office considers.

With the lion’s share of this information amassed, an underwriter will crunch the numbers and designate you a course of action. If you acted everything, you’ll be allotted a Preferred Plus rating. That supports you secure the least fiasco assurance premiums. If there are a couple of inconveniences for you, like hypertension, you’ll be dropped to cut down classes like Preferred, Standard Plus, and Standard properly. Smokers will get Tobacco game plans.

Examine more in our start to finish manual for additional security orders.

Incorporation entirety and term length

How much debacle assurance you require is a two-segment question: How much incorporation you need, and to what extent you necessitate that consideration to last. Both are imperative, and both impact the cost of life inclusion. Techniques with higher incorporation aggregates cost more, as do approaches that last more.

Note that to what degree the system persists is simply suitable to term debacle assurance. Enduring life inclusion doesn’t have this imprisonment, anyway costs more. More on this capability underneath.

Cheapest Term Life Insurance:The Cost of Life Insurance

Riders:

Riders look like little scale contracts added to calamity insurance plans that consider customization and game plans for individual circumstances. Regardless, dependent upon the plan, there could be an additional cost that doesn’t make the rider defended, notwithstanding all the inconvenience. A landing of-premium rider limits premiums toward the completion of a course of action term, yet you might be in a perfect circumstance having contributed that money; waiver-of-premium, coincidental passing, or child incorporation riders are in like manner usually worth the extra expense.

Everyone’s condition will be one of a kind, and a couple of riders may be advantageous, anyway you should constantly consider the potential additional cost before adding one to your game plan.

Kind of additional security

Life inclusion comes in different sorts. Term is the most notable and most sensible; enduring methodologies are progressively exorbitant yet have extra points of interest, like a theory style cash part.

The sort of calamity insurance you have — term or ceaseless, and which unequivocal kind of enduring assurance — will, all things considered, impact the cost of the methodology. We will go into the two most acclaimed sorts, term and whole, underneath, yet you can get comfortable with interchange sorts fiasco insurance.

Term additional security cost:

A term life inclusion course of action is the right methodology for a large number individuals. A sound 30-year-old male can want to pay an ordinary of $21 every month for a 20-year approach. Rather than enduring methodologies, there are no “extra things” with term assurance that raise the rates; you essentially should think about the components recorded already.

Get comfortable with term life inclusion rates.

Cost of whole catastrophe security

While term security is conventionally sensible, whole catastrophe insurance is typically commonly exorbitant. Whole game plans can be six to numerous occasions as expensive as a basically indistinguishable term approach. This is in light of the fact that:

It props up longer. Term life has an end date, anyway whole life doesn’t. As the name induces, it props up for as far back as you can recall as long as the month to month premiums are paid, and more likely than not, stunning the technique is dynamic.

There’s an additional cash regard fragment. Like distinctive sorts of immutable additional security, whole life has a cash regard section despite a debacle insurance part. Premium portions are part between these contrary sides, inciting higher rates.

There are more charges. In light of the above centers, there are the board accuses related of whole life inclusion that are joined into premium rates.

Cheapest Term Life Insurance:The Cost of Life Insurance

Get comfortable with whole life inclusion rates.

There are particular techniques for discovering moderate catastrophe assurance, and perceiving what goes into the cost before you get additional security refers to empowers you to settle on the best decisions in the midst of the application methodology and find a procedure that suits your money related arrangement.

What influences the expense of extra security?

To figure the amount you may pay for extra security, your back up plan’s financiers think about the amount you’re searching for, your general well-being and even your diversions and propensities.

Measure of inclusion.: Run of the mill approach types are term life and entire life. Term arrangements are for times of 10, 15, 25 or 30 years, contingent upon the safety net provider, while entire life normally covers you until the point that you kick the bucket. Most arrangements offer additional items or riders to cover unforeseen ailments or in abilities, incorporating youngsters in your inclusion or offers money esteem that you can get against.

Your age.: With maturing comes a higher probability of recording a case. Financiers use recipes and tables to decide your chances of passing without end inside your sex and statistic, collapsing these chances into their general figuring that decide the amount you’ll pay.

Your occupation.: In the event that your activity places you in risky circumstances — for example, mining or news coverage — you’ll likely pay more than somebody in publication or bookkeeping.

Your sexual orientation.: Studies demonstrate that ladies will in general live longer than men, which regularly results in lower premiums for ladies.

Your way of life.: Financiers think about how regularly and the amount you drink liquor, regardless of whether you take an interest in high-chance games and undertakings and even how well you drive out and about. Yet, smokers will in general pay the most astounding premiums.

Your well-being history.: In the event that you have a previous medicinal condition or a past filled with malignant growth, hypertension, diabetes, your back up plan may charge more for inclusion. It might much consider the soundness of your more distant family when assembling a statement.

Cheapest Term Life Insurance:The Cost of Life Insurance

What amount of extra security do I require?

Endeavoring to decide how much inclusion you require depends a great deal on your particular way of life and who relies upon you. For instance, would you say you are hitched with children? Or then again would you say you are simply beginning in reality?

In case you’re thinking about applying for an extra security strategy, consider:

Your pay.: If you somehow managed to pass on surprisingly or got yourself unfit to work because of an ailment or damage, how might your family adopt without your salary? Search for disaster protection arrangements that are sufficient to supplant your salary until the point when any obligations are completely paid.

Your costs.: Do you claim a home loan, vehicle advance, charge card or different obligations? Ascertain the continuous costs your family needs to keep up their present and future way of life.

Your wards.: On the off-chance that your family incorporates individuals who rely upon you fiscally, think about their future needs. For example, your youngsters will probably head off to college, or older guardians may require care. Factor in any costs your family relies upon.

Your benefits.: Assess your stock offers, reserve funds and retirement records and speculation properties. Could your family easily live off these, or would you rather they keep giving those speculations a chance to manufacture?

Utilize our disaster protection adding machine for a snappy gouge on how much inclusion you may require.

How might I chop down my disaster protection costs?

Your general therapeutic history and different components might be out of your hands. Be that as it may, you can make a couple of moves to possibly bring down your premium.

Stop smoking:. In case you’re a smoker, a coherent advance to decrease your premium — and enhance your well- being — is to kick the propensity when you can. Doing as such can enable you to maintain a strategic distance from rates that are twofold or more that of a nonsmoker.

Cut down on drinking.: A couple of beverages won’t have quite a bit of an impact on your rates. Yet, in the event that you will in general appreciate in excess of a beverage daily, consider decreasing your liquor admission for lower rates.

Get fit as a fiddle.: Safety net providers consider your weight and the amount you practice a vital piece of deciding danger. A lower BMI commonly results in less expensive rates.

Consider real life changes.: Your extra security approach should change with your requirements. For example, after your youngsters are developed and supporting themselves, you can frequently diminish your inclusion.

Search for limits.: A trap to keeping more cash in your pocket is to look chances to spare. Converse with your supplier about the likelihood of less expensive premiums with a family or joint strategy, as opposed to an individual arrangement.

Cheapest Term Life Insurance:The Cost of Life Insurance

Legends about disaster protection

When settling on a disaster protection strategy, your family’s insurance and security are frequently at the front line of your worries. However, numerous individuals quit the well-being net disaster protection makes since they don’t see how it functions inside sound budgetary arranging.

Here are the main three reasons individuals refer to for leaving life coverage.

Disaster protection is excessively costly.: It may sound hard to factor in premiums for one more protection plan. In any case, extra security is an advantageous speculation that can keep your family from managing obligation and superfluous hardship after you bite the dust. You can keep premiums low by purchasing just the inclusion you require.

It’s a misuse of cash.: Extra security is intended to ensure those you adore in the midst of need. Think about how your family would adapt on the off-chance that you were harmed and unfit to work? An extra security approach could enable them to stay aware of home loan reimbursements, charge card obligation and progressing costs.

Applying for inclusion is a long, hard process.: The facts demonstrate that numerous protection suppliers require a medicinal test and inside and out guaranteeing forms. Be that as it may, in case you’re agreeing to accept a long haul or entire life, the significant serenity that your family is secured could exceed the one-time bother. You’ll likewise discover suppliers offering arrangements without restorative tests with snappy endorsement, however frequently with higher premiums.

Cheapest Term Life Insurance:The Cost of Life Insurance

Philosophy:

To give the information on this page, we found the middle value of rates cited by 14 disaster protection organizations for people in incredible well-being. We got these rates from Quota in 2018, which implies they’re liable to change. Not all disaster protection organizations offer approaches for all age ranges, be that as it may. Some age reaches may have been arrived at the midpoint of from less organizations.

Also Read the following Article——–

Money making ideas : Top 5 ways to make money online

For Reference CLICK HERE